Outsourced CFO vs. In-House Finance Team: A Complete Cost & Benefit Analysis

7/23/20252 min read

Your business is scaling rapidly, and the financial complexity is growing with it. You know you need high-level financial leadership, but you've reached a critical crossroads: do you hire a full-time, in-house CFO or Controller, or do you partner with an outsourced accounting and CFO service?

This isn't just a simple hiring decision; it's a strategic choice that will impact your budget, scalability, and access to expertise. Let's break down a complete cost and benefit analysis to help you make the right choice for your business.

More Than Just a Salary

At first glance, comparing a monthly retainer to a full-time salary seems straightforward. However, the true cost of an in-house employee goes far beyond their paycheck.

In-House CFO/Controller:

Average Salary: A skilled CFO's salary can easily be $150,000 - $250,000+, while a Controller might be $90,000 - $150,000.

Benefits & Taxes: Add another 25-35% on top of salary for payroll taxes, health insurance, retirement contributions, and paid time off.

Recruiting & Training: The costs associated with finding, interviewing, and onboarding a high-level employee can be substantial.

Technology & Tools: You are responsible for the cost of accounting software, reporting tools, and other necessary technology.

Total Annual Cost: A seemingly "$150k" CFO can easily represent a $200,000+ annual commitment.

Outsourced CFO Service:

Monthly Retainer: You pay a fixed monthly fee based on the scope of your needs. This fee is predictable and can range from a few thousand to several thousand dollars per month.

No Hidden Costs: The outsourced firm covers all of its own overhead, including salaries, benefits, training, and technology.

Total Annual Cost: A comprehensive outsourced service might cost $40,000 - $80,000 annually, providing C-level expertise for a fraction of the in-house cost.

Beyond the Numbers

Cost is only one part of the equation. The strategic benefits are where the outsourced model truly shines for most growing businesses.

Expertise:

In-House: You get the expertise of one or two individuals.

Outsourced: You gain access to an entire team of specialists—bookkeepers, controllers, tax experts, and CFOs—who have experience across dozens of industries and business models. You benefit from their collective knowledge.

Scalability:

In-House: Your capacity is fixed. If you have a major project or a sudden downturn, you are stuck with a fixed overhead.

Outsourced: The service is elastic. You can easily scale your support up or down as your business needs change, ensuring you only pay for what you need.

Objectivity:

In-House: An employee can sometimes become entrenched in company politics or internal biases.

Outsourced: An external partner provides a crucial, unbiased perspective on your business's performance and challenges, allowing them to ask tough questions and provide candid advice.

Focus:

In-House: Hiring, managing, and developing an internal finance team takes significant time and energy away from your core responsibilities as a leader.

Outsourced: You get to focus on what you do best—leading the company—while a dedicated team of experts manages the entire finance function.

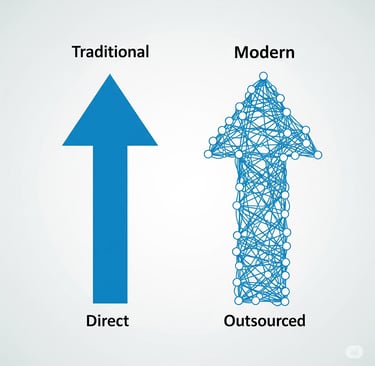

The Right Choice for Growth

While very large, publicly-traded corporations may require a full-time, in-house finance team, the vast majority of growing private businesses find that the outsourced model provides superior value, deeper expertise, and greater flexibility. It's the modern, efficient way to build a world-class finance function.

Growth

Empowering businesses with financial clarity and support.

Finance

Clarity

info@bkc-bookkeeping.com

+13128234616

© 2025. All rights reserved.

BKC Solutions Management LLC.,